Shoppers prefer retailers’ payment apps to Apple Pay, Android Pay

2017.02.15

Consumers are embracing mobile payment applications, with more than 25 percent of smartphone owners in the United States using these platforms at least once a month, according to new research from Parks Associates.

The report, Context is King: Monetizing Consumer Data for Commerce, finds that retailers are also getting on board, with more than 3 million retailers combined accepting Apple Pay and Android Pay. However, consumers use retailer-specific apps more frequently, such as the Starbucks app, which accepts 5 million transactions per month.

“For merchants with a loyal customer base, mobile payment functionality is a helpful addition to a merchant-specific mobile wallet that allows customers to earn loyalty rewards, save gift cards, and redeem coupons,” said Chris Tweedt, a research analyst at Parks Associates. “These merchants should use payment functionality from within the wallet to alert customers about coupons and offers as they make a purchase and to link transactions to specific customers in order to effectively validate marketing campaigns, evaluate merchandise strategies, segment shoppers, and improve ad targeting.

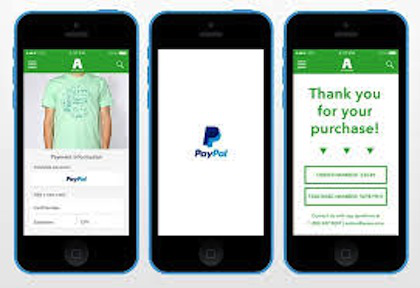

“Retailers should also plan to accept leading mobile payment solutions – Apple Pay, Android Pay, and PayPal – soon,” he said. “Although consumer adoption of these solutions is low, merchant adoption is rising quickly, and once a critical mass of merchants accept these solutions, Parks Associates expects consumer adoption to increase sharply.

“Retailers who are late to accepting these solutions may miss the opportunity to influence retail payment experience and obtain insights from adopters’ purchase and app usage behaviors.”

Winning adoption

Retailers large enough to create their own mobile payment app solutions are currently winning most of the adoption, per the report.

One benefit of large retailer apps that offer payments is the ability to control all aspects of the payment app experience within their stores.

The challenges retailers see with embracing other payment apps include high upgrade costs of point-of-sale payment terminals, payment apps acting as gatekeepers to their shoppers’ data, shoppers’ confusion with various mobile payment options, and slow checkout speeds using payment apps versus credit card swipes.

PayPal continues to be the leader in mobile payments apps and is used by one in five smartphone owners. PayPal is also a leader in user spending, with the One Touch payment capability adopted by 7 million consumers and accepted by 1 million retailers.

Popular categories

App developers can reach almost 75 percent of current payment app users in the U.S. by supporting payments in three popular categories – food and drink, clothes and tickets for live events.

New digital wallet app developers who targeted this opportunity with wallet apps for loyalty programs have had varying degrees of success, per the report. For example, the Key Ring app, which serves targeted ads on deals from major brands and delivers digital coupons using location-based targeting, boasts 12 million users.

Walmart Pay is available in the retailer’s app

“The fact that 25 percent of smartphone users in the U.S. have started using payment apps bodes well for the mobile payment industry,” Mr. Tweedt said. “The challenge is to encourage consumers to increase usage frequency and boost spending through these payment apps.

“Merchants and retailers must work closely with payment solution providers to drive usage and raise mobile payment app’s visibility further through coordinated marketing and promotions,” he said.

Source: Mobile Commerce Daily

Visitor Registration

Visitor Registration Booth Application

Booth Application